NatWest Banking

Case Study - Concept App

Role

UX Designer

Date

2020

Platform

Mob App

Concept Brief

NatWest are keen to explore what can be done to support clients through products, services and customer experiences. At NatWest, their ambition is to help customers achieve their ambitions. Simply, to put customer needs at the heart of everything we do.

My Role

My responsibilities included conducting user research, usability testing, creating prototypes, iterating on designs and creating a promotional video.

Key App Features

Create Saving Pots

The app encourages to save more using instant creation of goals.

This product offers 3 types of saving goals programs with exclusive interest rates for premier customers.

2. Get Categorized Expenditures

Visualize your expenses in a dedicated section that include all the categories relevant to your purchases.

See detailed view of each category and access to each transaction.

3. Exchange Currencies

An option for frequent travelers or investors looking to diversify in different currencies. This product provides access to live currency exchange rates and a simple purchase process.

4. Quick Assistance with Banking Manager

Customers are provided with quick access to contact their banking manager through their preferred contact method.

Design Process

Discovery Phase

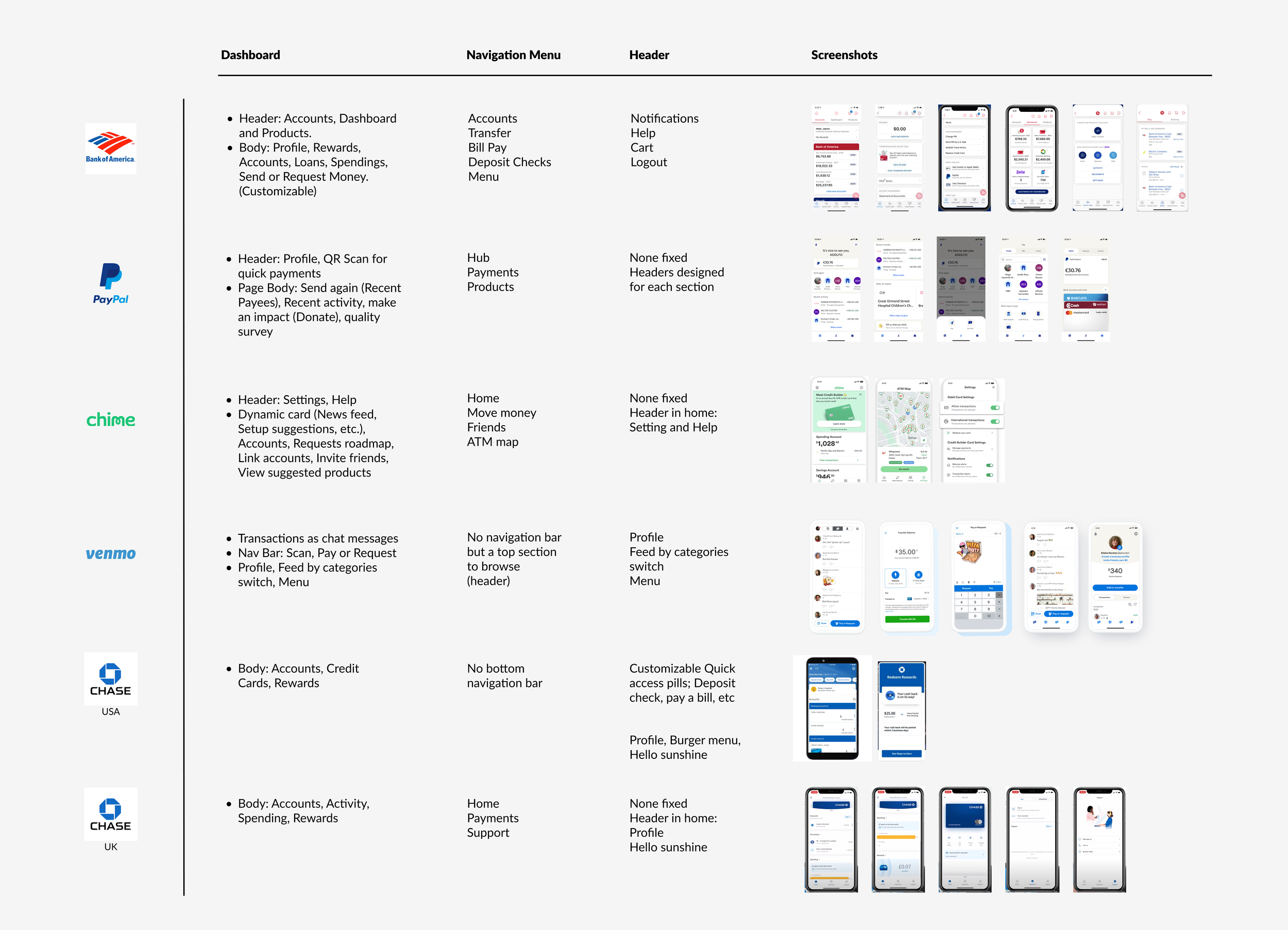

Benchmarking

The goal was to analyze best-in-class mobile UX offerings. This helped to understand their main navigation, explore home page, offerings, and gather visual inspiration.

Direct competition was analyzed, focusing on the features of each product, ease of navigation, and UI design. This analysis helped identify opportunities to differentiate our solution from the competition. For example, only Revolut offered unique services such as currency exchange, while HSBC provided personalized assistance; however, its UI could be improved.

Define Phase

After the research phase a UX report was delivered including competitive analysis, brand analysis, market research, personas and empathy maps which helped map the next steps.

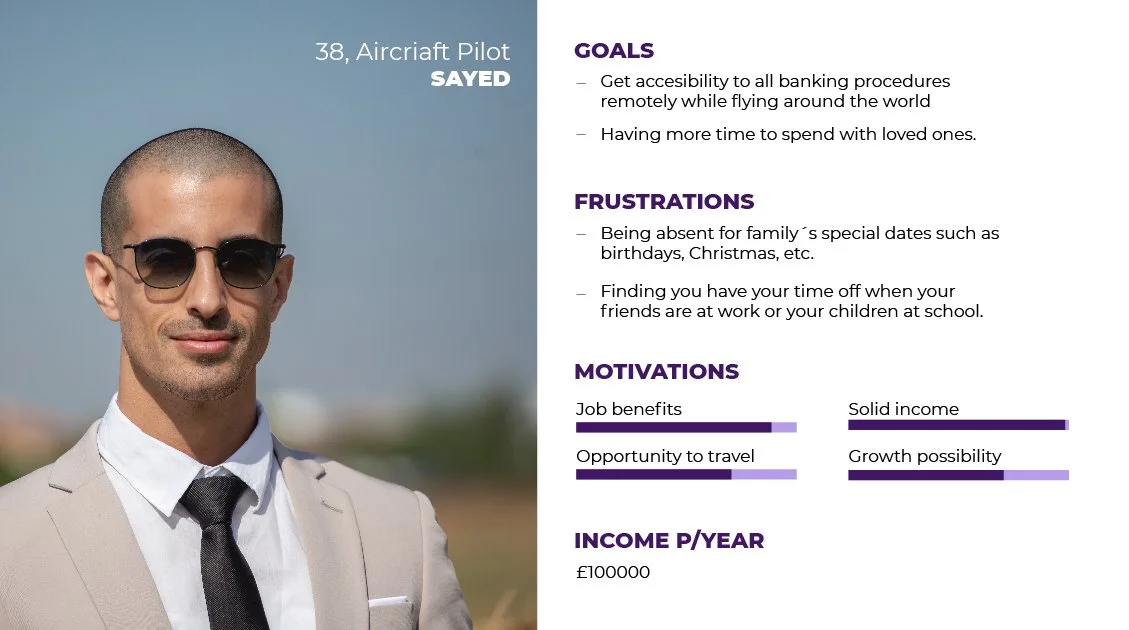

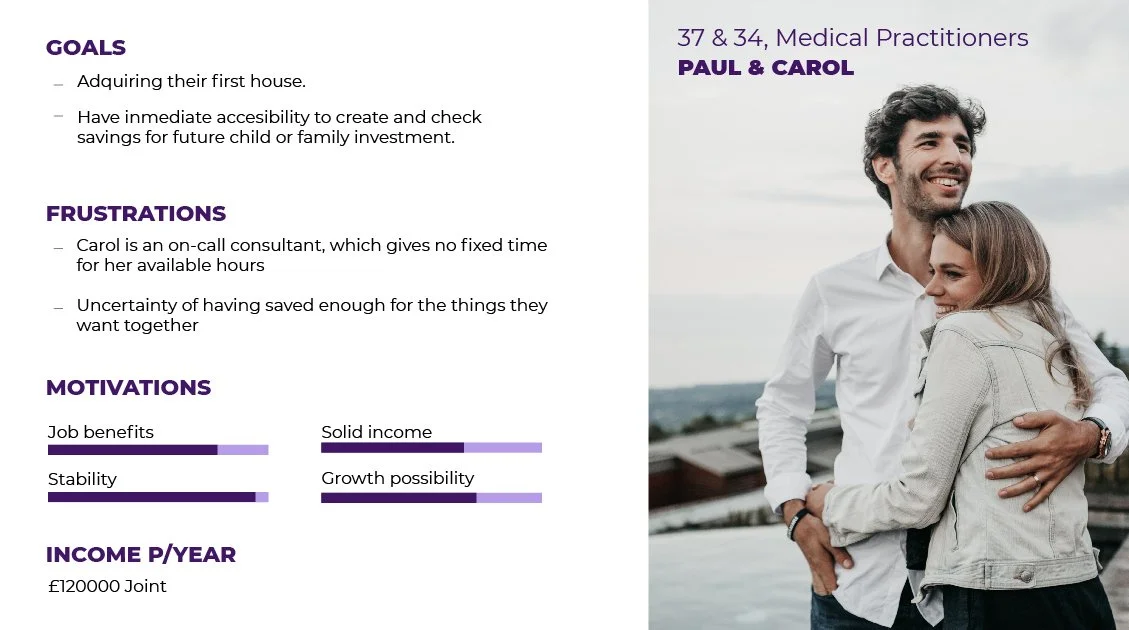

User Persona

The personas were categorized into two potential user groups. The “Busy Achievers“ and the “Striving and Supportive” based on the research from Statistica’s (2016) Mobile Payments in the United Kingdom report. These personas along with the empathy maps helped to identify potential touchpoints with Natwest Premier products.

Issues to Address

Customer reviews and ratings of existing Premier App.

User flow on the website directs to call.

Competitors banks offer more flexibility and extra features.

Only 60% NatWest users agree they have good customer service.

Users are willing but can not organize savings for different goals within the app.

Users find it hard to manage spending in their banking app.

User Stories

As a user, I want to quickly contact my banking manager so I can resolve issues as efficiently as possible.

As a user, I want to see my spending broken down by category so I can better understand and manage my expenses.

As a user, I want to access live currency exchange rates and purchase foreign currencies so I can manage my international finances with ease.

As a user, I want to create saving goals tailored to my needs so I can stay motivated and track my financial progress.

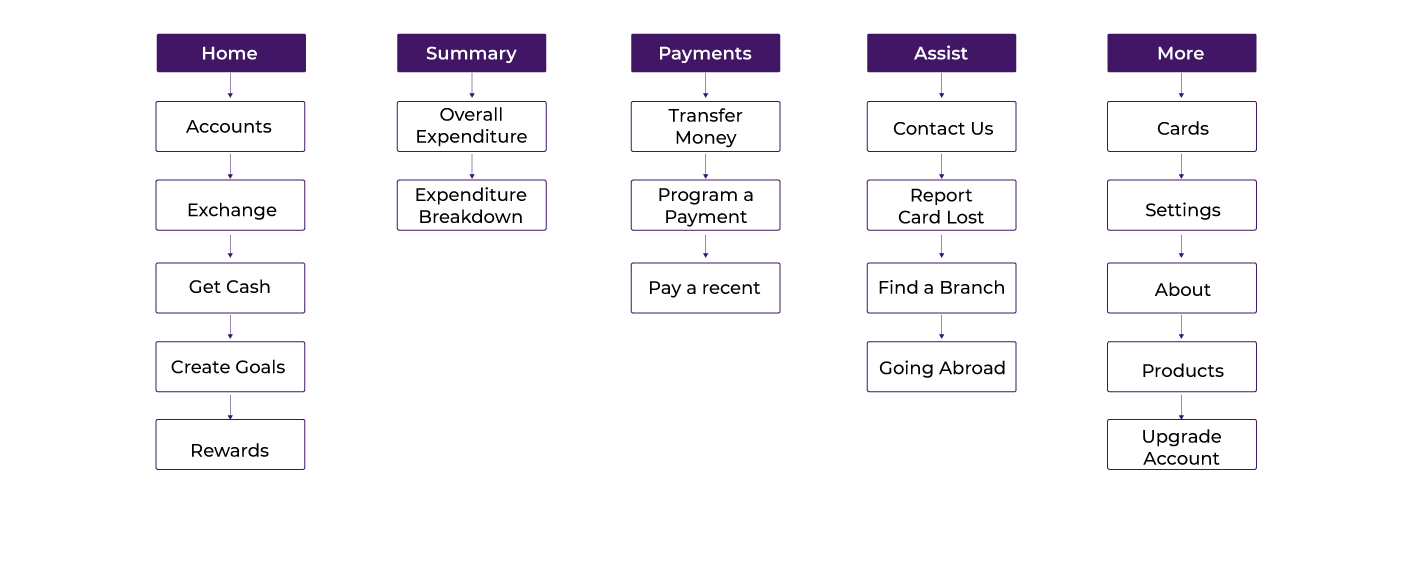

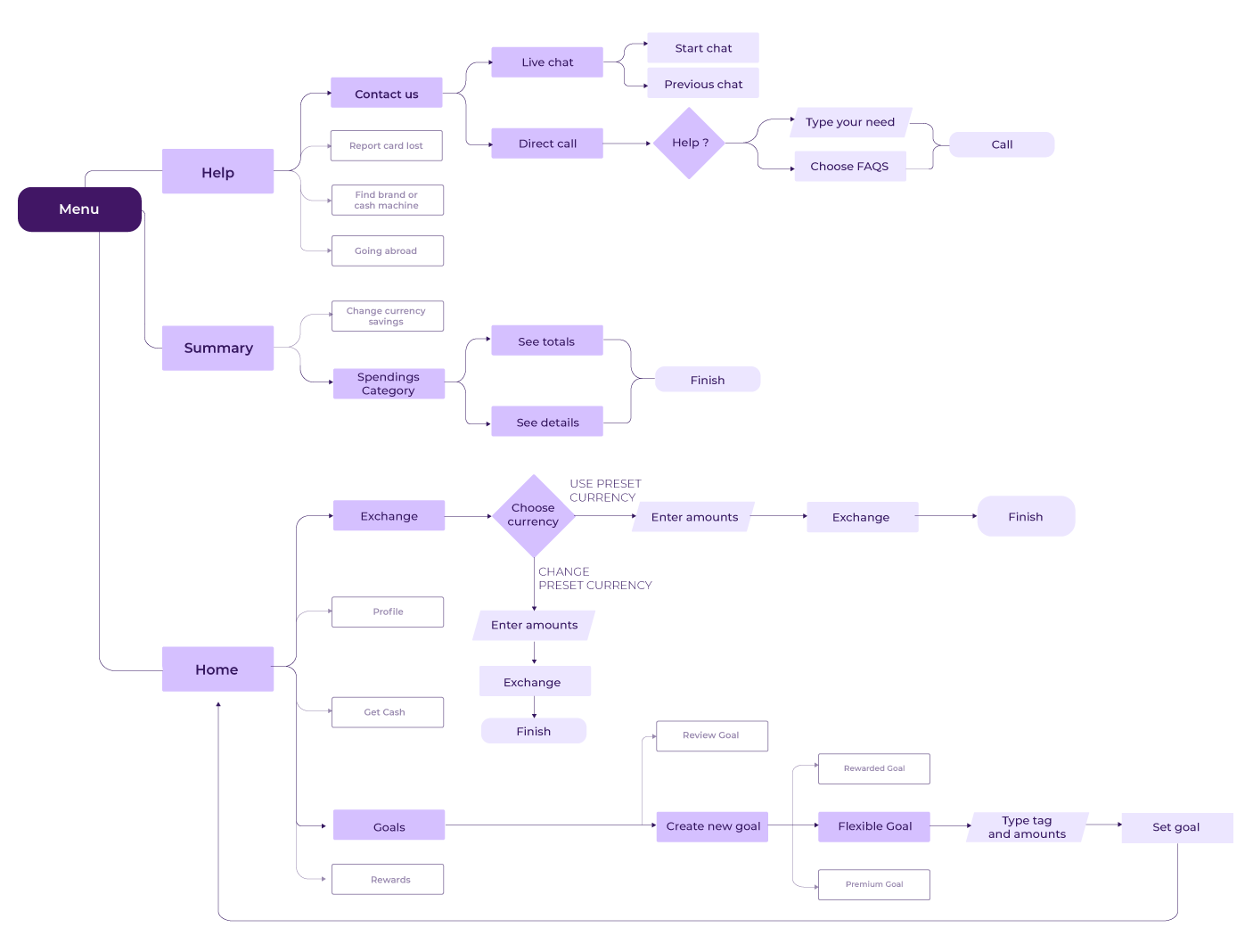

Information Architecture

Ideation

User Flows

Wireframes

Deliver

Hi-Fi screens

This project was created as part of a series of the UX, Interactive Design, Mobile Apps and Wearable Devices project of the Postgraduate Degree in Interactive Media Practice (MA), from the University of Westminster.